Governance Structure

Introduction of performance linked portion to the asset management reward structure

Remuneration paid by Nippon Hotel & Residential Investment Corporation to the Asset Manager consists of management fee I, management fee II, acquisition fee, disposition fee, and merger fee.

| Management fee I | Total assets at end of previous accounting period(Note1) × 1.0% per annum (ceiling) |

|---|---|

| Management fee II | Management fee II for previous accounting period × (DPU before deduction of current period management fee II/DPU before deduction of previous period management fee II) × management fee II revised ratio |

| Acquisition fee(Note 2) | Acquisition price × 1.0% (ceiling) (transaction with related party: 0.5% (ceiling)) |

| Disposition fee | Disposition price × 1.0% (ceiling) (transaction with related party: 0.5% (ceiling)) |

| Merger fee | Appraisal value at the time when a merger takes effect X 1.0% (upper limit) |

| (Note 1) | Subject to adjustment for asset acquisitions and asset dispositions during the relevant calculation period. |

|---|---|

| (Note 2) | Where the sum calculated for an acquired asset is less than 5 million yen, the acquisition fee is set at 5 million yen. |

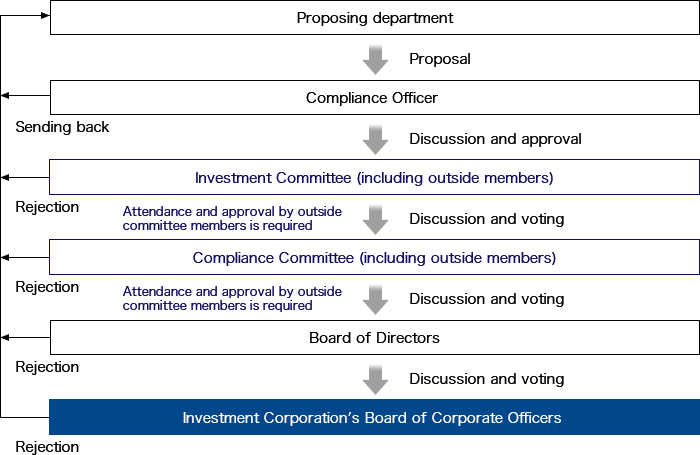

Flowchart of decision-making in asset acquisition and disposition with related party.